Bookkeeping and accounting used to be desk- work that tradespeople had to “get back to the office” to deal with at the end of a busy day. It’s no wonder that so many tasks were just left to pile up until they had to be dealt with (usually in a rush at year end, or when applying for a loan). This translated to higher accounting fees and lost tax planning (saving) opportunities.

If you are considering a move to cloud accounting from a desktop system, here are 3 great reasons to make the switch so you don’t have to “get back to the office” so often.

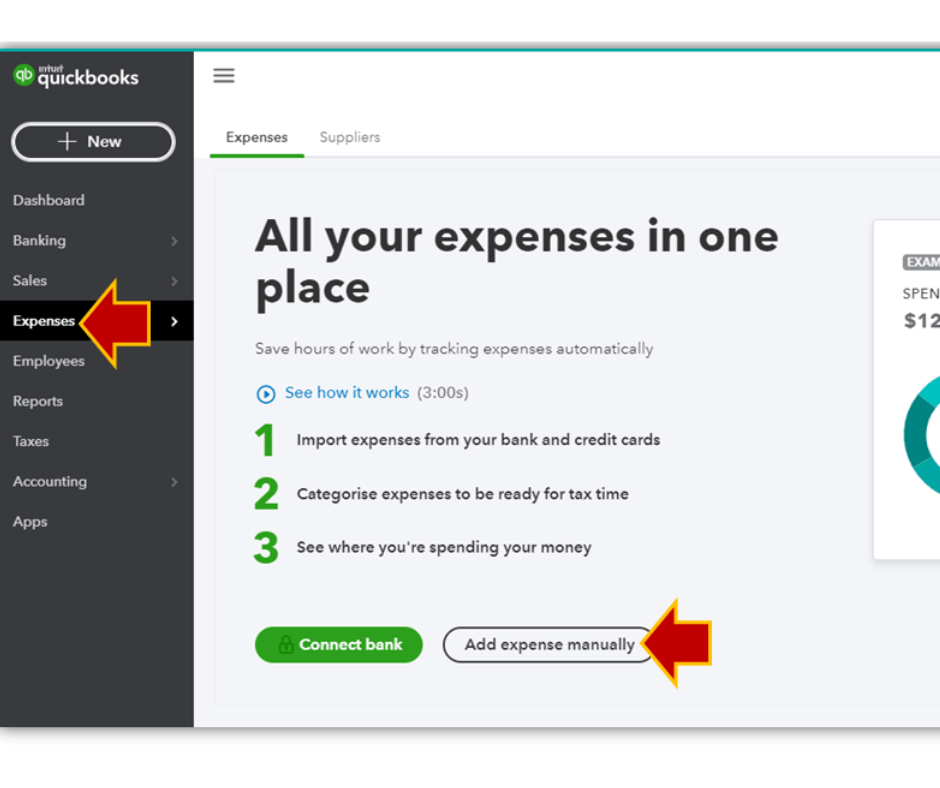

Mobile Expense Tracking

Both Quickbooks Online and Xero accounting software systems allow for employees to upload expenses for reimbursement (receipts or tracked mileage) using a mobile phone application. Expenses are entered in a more complete and timely manner.

Mobile Estimates/Invoicing

Customer estimates can be created using a mobile phone application and uploaded directly to accounting software. The estimate can then be turned into an invoice when it comes time to bill the customer. Estimates issued in real time tend to be more comprehensive and reflect actual details provided by the customer (instead of input later with reliance on notes or memory). Invoices can also be issued and payments accepted without using a bricks and mortar office set up at all.

Cloud File Storage

Consider moving your back- end filing cabinet online. A google drive, for example, can be linked to your phone and photos of documents or job sites can be uploaded or accessed from any location. This allows you to perform many different tasks without tying up time and resources returning to a physical office to catch up on filing.

Moving to a cloud accounting system does not have to be complicated and can improve efficiency in a myriad of ways. Try scheduling 20 minutes next week to read up on Quickbooks Online or Xero.